Open evening Brescia

(In)formati a Brescia: esplora il tuo futuro Postlaurea!

Partecipa ad una serata di informazione il 18 marzo! Parla con i referenti dei Master, incontra gli alumni e scopri l’offerta della Formazione executive: CattolicaPer, Servizi di Psicologia, Formazione continua e Job talk!

Open evening Brescia

(In)formati a Brescia: esplora il tuo futuro Postlaurea!

Partecipa ad una serata di informazione il 18 marzo! Parla con i referenti dei Master, incontra gli alumni e scopri l’offerta della Formazione executive: CattolicaPer, Servizi di Psicologia, Formazione continua e Job talk!

Scegli il tuo percorso

In evidenza

Eventi

178 elementi trovati

-

Orientamento lauree triennali OLTRE IL FILM: incontri tra scienza e cinema

Brescia - Dal 21 gennaio 2025 al 09 aprile 2025 -

seminario Corso di formazione per la ricerca bibliografica, banche dati, struttura tesi di laurea

Roma - Dal 07 marzo 2025 al 28 marzo 2025 -

Covegno La Speranza nella Cura: un percorso di Fede, Scienza e Umanità

Roma - Dal 12 marzo 2025 al 13 marzo 2025 -

Ciclo di Lezioni Il patrimonio culturale e la sua valorizzazione

Milano - 13 marzo 2025 -

Conferenza Ars Docendi

Milano - 13 marzo 2025 -

Il Pianoforte in Ateneo Il Pianoforte in Ateneo

Milano - 13 marzo 2025 -

Lezione aperta Sviluppo turistico e pianificazione del territorio

Brescia - 13 marzo 2025 -

Dies Academicus Dies Academicus 2024-2025

Piacenza - 13 marzo 2025 -

presentazione volume Elementi di arbitrato commerciale internazionale

Milano - 13 marzo 2025 -

Lezione aperta Paura, desiderio, speranza

Milano - Brescia - 13 marzo 2025 -

STAGE&PLACEMENT Cv Point – Gi Group

Milano - 13 marzo 2025 -

Lezione aperta Le parabole tra Vangelo e tradizione rabbinica

Milano - 13 marzo 2025 -

Lezione aperta Non esistono ragazzi cattivi

Milano - 13 marzo 2025 -

Lezione aperta La valutazione nella cooperazione internazionale allo sviluppo

Milano - 13 marzo 2025 -

Lezione aperta La situazione della Palestina nel prisma degli organi internazionali di giustizia

Milano - 13 marzo 2025 -

Lezione aperta Orizzontalità del diritto

Milano - 13 marzo 2025 -

Seminario Il modello Unesco

Milano - 13 marzo 2025 -

Seminar The future of communication

Milano - 13 marzo 2025 -

Seminario internazionale L'immagine dell'arabo nella cultura occidentale vs l’immagine dell’occidente nella cultura araba

Milano - 14 marzo 2025 -

Lezione aperta “Quinquagenarium, qui proprie poenitentium est, juxta jubilaeum” (Hier. Ep. 121 ad Algasiam): Girolamo e la cristianizzazione del Giubileo

Brescia - 14 marzo 2025 -

Series of lectures International arbitration through the eyes of practitioners

Milan - 14 March 2025 -

Lezione aperta Il potere governativo tra norma e prassi

Brescia - 14 marzo 2025 -

Lezione aperta Paura, desiderio, speranza

Milano - Brescia - 14 marzo 2025 -

Ciclo di Seminari La Chiesa “esperta in umanità”

Milano - 14 marzo 2025 -

Ciclo di seminari Le politiche della Regione Lombardia al servizio della competitività e della sostenibilità

Cremona - 14 marzo 2025 -

Incontro Vedere l'infinito

Milano - 14 marzo 2025 -

Seminario Exploring new technologies (chat gpt) for foreign languages, linguistics and literature

Milano - 14 marzo 2025 -

Convegno Alberto Manzi. Conoscere un maestro per crescere

Milano - 14 marzo 2025 -

Workshop Artificial Intelligence, Machine Learning e pratica attuariale

Milano - 14 marzo 2025 -

Ciclo di lezioni Linguistica storica e filologia (4^ edizione)

Milano - 17 marzo 2025 -

Series of lectures International arbitration through the eyes of practitioners

Milan - 17 March 2025 -

Webinar Giurisprudenza e Linguaggi dei media: modalità di ammissione e indicazioni tecniche

Milano - 17 marzo 2025 -

Lezione aperta Gli studi e l’interesse per la storia romana e greca in Giappone in epoca tardo edo e meiji (1800-1912)

Milano - 17 marzo 2025 -

Presentazione volume Cos’è (e non è) l’UE: il punto di vista del diritto amministrativo europeo

Milano - 17 marzo 2025 -

Presentazione volume La trappola dei conflitti intrattabili

Milano - 17 marzo 2025 -

Stage&Placement - Facoltà di Scienze linguistiche e letterature straniere L’entreprise en évolution

Brescia - 17 marzo 2025 -

Lezione aperta Italo Svevo, lo scrittore degli ossimori

Milano - 18 marzo 2025 -

Ciclo di incontri Natura e sostenibilità: verità e miti tra illusioni e speranze

Cremona - 18 marzo 2025 -

Lezione aperta Il management del volontariato attraverso l’accompagnamento: riflessioni e modelli dalla ricerca internazionale

Brescia - 18 marzo 2025 -

Seminario Il “De Magno Schismate” di Antonio Baldana

Milano - 18 marzo 2025 -

Seminario Alleanze e potere marittimo: il ruolo dell'Italia

Milano - 18 marzo 2025 -

Seminario Oltre l’informazione. Popotus, risorsa educativa per la scuola

Brescia - 19 marzo 2025 -

Ciclo di Seminari Raccontare l’economia

Milano - 19 marzo 2025 -

Stage&Placement Career Hub - Dai un boost alla tua carriera!

Milano - 19 marzo 2025 -

Orientamento Incontro di preparazione al TIEC: Test di Ingresso a Economia in Cattolica

Online, su Webex - 19 marzo 2025 -

Presentazione volume Accabò

Brescia - 20 marzo 2025 -

Ciclo di Seminari La Traduzione Letteraria

Milano - 20 marzo 2025 -

Conferenza “Science and Religion Studies”: riflessioni su un settore disciplinare

Brescia - 20 marzo 2025 -

Seminario Scrivere la memoria triennale e la tesi di laurea magistrale

Brescia - 21 marzo 2025 -

Conferenza Per una cultura della legalità

Brescia - 21 marzo 2025 -

Convegno Il tedesco, perché SÌ!

Brescia - 21 marzo 2025 -

Seminario internazionale Conoscenza profetica e libertà umana tra medioevo e rinascimento

Milano - 24 marzo 2025 -

Ciclo di lezioni Linguistica storica e filologia (4^ edizione)

Milano - 24 marzo 2025 -

Series of lectures International arbitration through the eyes of practitioners

Milan - 24 March 2025 -

Stage & Placement Gestire la sostenibilità: l’approccio di RAJA Italia

Piacenza - 24 marzo 2025 -

Lezione aperta L’invenzione di Shanghai

Brescia - 24 marzo 2025 -

Stage & Placement Il ciclo incassi-pagamenti e la dinamica finanziaria riflessa nell'informativa di bilancio

Piacenza - 24 marzo 2025 -

Recruiting Day Recruiting Week

Milano - Dal 24 marzo 2025 al 28 marzo 2025 -

Seminario Pensare la politica

Milano - 25 marzo 2025 -

Ciclo di Seminari Climate change, diritti umani, sostenibilità ed esg

Milano - 25 marzo 2025 -

Ciclo di incontri Quando il dramma umano canta. La speranza sulle ali della musica

Cremona - 25 marzo 2025 -

Convegno D’annunzio: una didattica da rifondare

Brescia - 25 marzo 2025 -

Workshop interdisciplinare Signore degli eserciti

Milano - 25 marzo 2025 -

Ciclo di Seminari La Chiesa “esperta in umanità”

Milano - 25 marzo 2025 -

Ciclo di incontri Il diritto internazionale privato nell’esperienza del giurista pratico

Milano - 25 marzo 2025 -

Seminario L’operazione Moncler-Stone Island

Piacenza - 25 marzo 2025 -

Ciclo di Seminari Costruire cittadinanze culturali. Territori montani ri_generati

Piacenza - 26 marzo 2025 -

Stage & Placement How to boost your communication efficacy

Piacenza - 26 marzo 2025 -

Stage & Placement Formulare e implementare la strategia: il caso Gruppo Zonin1821

Piacenza - 26 marzo 2025 -

Stage & Placement IL COLLOQUIO DI GRUPPO ricreato attraverso la metodologia dell’ASSESSMENT CENTER. Case study con focus su analisi e risoluzione di una situazione lavorativa.

Piacenza - 26 marzo 2025 -

STAGE&PLACEMENT LinkedIn Game & Lab

Milano - 26 marzo 2025 -

Ciclo di Seminari Raccontare l’economia

Milano - 26 marzo 2025 -

Stage & Placement Training Public Speaking Skills for personal and academic success

Piacenza - 27 marzo 2025 -

Stage & Placement CONSULENZA STRATEGICA COMMERCIALE

Piacenza - 27 marzo 2025 -

STAGE&PLACEMENT Simulazioni individuali del colloquio di selezione - Umana

Milano - 27 marzo 2025 -

Ciclo di Lezioni Il patrimonio culturale e la sua valorizzazione

Milano - 28 marzo 2025 -

Incontro Niccolò Tartaglia: un matematico bresciano nell’Italia del Cinquecento

Brescia - 28 marzo 2025 -

Seminario 13° Tesi day

Brescia - 28 marzo 2025 -

Open Day Open Day Unicatt

Brescia, Cremona, Milano, Piacenza - Dal 28 marzo 2025 al 12 aprile 2025 -

Ciclo di Seminari La Chiesa “esperta in umanità”

Milano - 28 marzo 2025 -

Lezione aperta Le chiavi del cielo e quelle della terra. Il giubileo di Bonifacio VIII (1300)

Brescia - 31 marzo 2025 -

Evento Mettiti nei miei panni

Cremona - 01 aprile 2025 -

Lezione aperta Freud aveva davvero ragione?

Brescia - 01 aprile 2025 -

Ciclo di lezioni I Giubilei nella storia

Milano - 01 aprile 2025 -

Inaugurazione della mostra Apocalisse: la speranza corre oltre il velo

Cremona - 01 aprile 2025 -

Stage & Placement INTERVIEW LAB | Prepare yourself by following the main guidelines and simulate an individual interview with the recruiter

Piacenza - 01 aprile 2025 -

Lezione aperta Pensare stanca. Passato, presente e futuro dell’intellettuale

Milano - 01 aprile 2025 -

Seminario Ai margini dell’Ecumene

Brescia - 02 aprile 2025 -

Conferenza Il problema di Plateau

Brescia - Dal 02 aprile 2025 al 04 aprile 2025 -

Ciclo di Seminari Opportunità e buone pratiche per le Aree interne e montane

Piacenza - 02 aprile 2025 -

Stage & Placement CONTROLLO QUALITA’ - ASSICURAZIONE QUALITA’

Piacenza - 02 aprile 2025 -

Ciclo di Seminari Raccontare l’economia

Milano - 02 aprile 2025 -

Ciclo di seminari Innovazione Armonica: una via italiana alle grandi sfide di transizione. L’esperienza di Entopan e dell’Harmonic Innovation Ecosystem

Cremona - 02 aprile 2025 -

Ciclo di Lezioni Il patrimonio culturale e la sua valorizzazione

Milano - 03 aprile 2025 -

Conferenza Ars Docendi

Milano - 03 aprile 2025 -

Il Pianoforte in Ateneo Il Pianoforte in Ateneo

Milano - 03 aprile 2025 -

Stage & Placement How to communicate with emotional intelligence. Let’s train with the LEGO® SERIOUS PLAY® method

Piacenza - 03 aprile 2025 -

Stage & Placement Competenze, cultura aziendale e attitudini personali: il TALENT MANAGEMENT come strumento per la valorizzazione delle risorse umane

Piacenza - 03 aprile 2025 -

Lezione aperta La scrittura del tennis. Giornalismo, letteratura, editoria

Brescia - 03 aprile 2025 -

Seminar The future of communication

Milano - 03 aprile 2025 -

Stage&Placement Simulazioni del colloquio di gruppo – The Adecco Group

Milano - 03 aprile 2025 -

Lezione aperta Il cantiere delle riforme istituzionali

Milano - 04 aprile 2025 -

Ciclo di seminari a.a. 2024/2025 FORmazione MEtodologica (FORME)

Milano - 04 aprile 2025 -

Stage & Placement LINKEDiN LAB | Create and publish the perfect profile

Piacenza - 04 aprile 2025 -

Ciclo di Seminari La Chiesa “esperta in umanità”

Milano - 04 aprile 2025 -

Ciclo di incontri Il diritto internazionale privato nell’esperienza del giurista pratico

Milano - 04 aprile 2025 -

Convegno inaugurale Novità dallo scavo di San Casciano dei Bagni (SI)

Milano - 04 aprile 2025 -

Seminario La professione docente. Aver cura delle relazioni dentro e fuori la scuola

Brescia - 04 aprile 2025 -

Seminario Exploring new technologies (chat gpt) for foreign languages, linguistics and literature

Milano - 04 aprile 2025 -

Seminario Le nuove frontiere per gli sviluppi sostenibili: AI, innovazione e formazione per la tutela dell’ambiente

Brescia - 04 aprile 2025 -

Formazione continua - Lifelong Learning L’embodied cognition nella riabilitazione: dalle neuroscienze alle pratiche evidence-based

Milano - 05 aprile 2025 -

Seminario internazionale Conoscenza profetica e libertà umana tra medioevo e rinascimento

Milano - 07 aprile 2025 -

Seminario Pensare la politica

Milano - 07 aprile 2025 -

Evento Shakespeare in musica

Milano - 07 aprile 2025 -

Ciclo di Seminari Climate change, diritti umani, sostenibilità ed esg

Milano - 08 aprile 2025 -

Evento Mettiti nei miei panni

Piacenza - 08 aprile 2025 -

Ciclo di lezioni I Giubilei nella storia

Milano - 08 aprile 2025 -

Celebrazione eucaristica In preparazione alla Santa Pasqua

Cremona - 08 aprile 2025 -

Incontri Pomeriggi manzoniani

Milano - 09 aprile 2025 -

Lezione aperta 5.000 anni di pratiche giubilari: note storico-religiose

Brescia - 09 aprile 2025 -

Ciclo di Seminari Appennino Hack

Piacenza - 09 aprile 2025 -

Stage & Placement Students give a presentation in pairs or alone. Discussion and Feedback

Piacenza - 09 aprile 2025 -

Stage & Placement PERSONAL BRANDING LAB | Marketing relazionale per presentazione di sé in chiave storytelling, job application e cover letter

Piacenza - 09 aprile 2025 -

Series of lectures International arbitration through the eyes of practitioners

Milan - 10 April 2025 -

Ciclo di Seminari La Traduzione Letteraria

Milano - 10 aprile 2025 -

Laboratorio didattico Insegnare la letteratura tedesca nella scuola secondaria superiore

Milano - 10 aprile 2025 -

Seminar The future of communication

Milano - 10 aprile 2025 -

Lectio L’utilizzo dell’intelligenza artificiale nello Stato della Città del Vaticano

Piacenza - 10 aprile 2025 -

Lezione aperta Gli istituti dell’amministrazione condivisa quale strumento di politica sociale nella città

Brescia - 11 aprile 2025 -

Giornata di studi Giornata Aldo Menichetti

Milano - 11 aprile 2025 -

Ciclo di Seminari La Chiesa “esperta in umanità”

Milano - 11 aprile 2025 -

Seminario L’adozione dei libri di testo. Quali implicazioni professionali ed etiche?

Brescia - 11 aprile 2025 -

Convegno Per una storia delle scienze politiche in Italia

Milano - Dal 13 aprile 2025 al 14 aprile 2025 -

Talks La storia di Gianluca GALLI, Founder e former owner di @QUAM

Piacenza - 14 aprile 2025 -

Incontro Semi di speranza nell’avventura della scienza

Brescia - 15 aprile 2025 -

Incontro Semi di speranza nell’avventura della scienza

Brescia - 15 aprile 2025 -

Stage & Placement Training Public Speaking Skills for personal and academic success

Piacenza - 16 aprile 2025 -

Ciclo di Seminari Raccontare l’economia

Milano - 16 aprile 2025 -

Ciclo di Seminari La Chiesa “esperta in umanità”

Milano - 28 aprile 2025 -

Ciclo di lezioni I Giubilei nella storia

Milano - 29 aprile 2025 -

Workshop interdisciplinare Signore degli eserciti

Milano - 29 aprile 2025 -

Lezione aperta L’anno del Grande ritorno e del Grande perdono. Il Giubileo del 1950

Brescia - 30 aprile 2025 -

Ciclo di Seminari La Chiesa “esperta in umanità”

Milano - 02 maggio 2025 -

Talks La storia di Guido RAVENNA, CEO Montebello Advisory

Piacenza - 05 maggio 2025 -

Scientific Colloquium The Hope for a Nourished Planet: which agenda for Catholic Universities?

Cremona - Dal 05 maggio 2025 al 06 maggio 2025 -

Ciclo di lezioni I Giubilei nella storia

Milano - 05 maggio 2025 -

PhD Course Non linear dynamics in economics and physics

Brescia - Dal 05 maggio 2025 al 08 maggio 2025 -

Lezione aperta Anno 1300: il Giubileo di Bonifacio VIII e gli artisti

Brescia - 06 maggio 2025 -

Lezione aperta Il Giubileo del 2000

Brescia - 06 maggio 2025 -

Evento Mettiti nei miei panni

Milano - Dal 06 maggio 2025 al 07 maggio 2025 -

Ciclo di lezioni I Giubilei nella storia

Milano - 06 maggio 2025 -

Seminario Costruire la salvezza

Brescia - 07 maggio 2025 -

Workshop interdisciplinare Signore degli eserciti

Milano - 07 maggio 2025 -

Lezione aperta I rapporti pubblico-privati nel sistema di accoglienza dei migranti umanitari

Brescia - 08 maggio 2025 -

Il Pianoforte in Ateneo Il Pianoforte in Ateneo

Milano - 08 maggio 2025 -

Stage & Placement Students give a presentation in pairs or alone. Discussion and Feedback

Piacenza - 08 maggio 2025 -

Ciclo di Seminari La Traduzione Letteraria

Milano - 08 maggio 2025 -

Stage & Placement RICERCA & SVILUPPO

Piacenza - 08 maggio 2025 -

Stage & Placement THE GROUP INTERVIEW recreated through the ASSESSMENT CENTER methodology. Case study with focus on analysis and resolution of a work situation.

Piacenza - 09 maggio 2025 -

Lezione aperta Lavorare scrivendo

Milano - 09 maggio 2025 -

Lezione aperta Retorica, poetica e critica letteraria nell’Italia del Seicento

Brescia - 09 maggio 2025 -

Seminario Exploring new technologies (chat gpt) for foreign languages, linguistics and literature

Milano - 09 maggio 2025 -

Ciclo di Seminari La Chiesa “esperta in umanità”

Milano - 12 maggio 2025 -

PhD Course Statistical Methods for Physical and Biomedical Sciences

Brescia - Dal 12 maggio 2025 al 27 maggio 2025 -

Evento Mettiti nei miei panni

Brescia - 13 maggio 2025 -

Workshop interdisciplinare Signore degli eserciti

Milano - 14 maggio 2025 -

Incontro con l'autore Daniele Mencarelli

Milano - 14 maggio 2025 -

Evento Workshop Prova l'orchestra e Concerto degli studenti

Milano - 15 maggio 2025 -

Ciclo di seminari a.a. 2024/2025 FORmazione MEtodologica (FORME)

Milano - 16 maggio 2025 -

Seminario internazionale Conoscenza profetica e libertà umana tra medioevo e rinascimento

Milano - 23 maggio 2025 -

Seminario Il diritto di contare

Brescia - 04 giugno 2025 -

Il Pianoforte in Ateneo Il Pianoforte in Ateneo

Milano - 05 giugno 2025 -

Ciclo di seminari a.a. 2024/2025 FORmazione MEtodologica (FORME)

Milano - 12 giugno 2025 -

Ciclo di seminari a.a. 2024/2025 FORmazione MEtodologica (FORME)

Milano - 19 settembre 2025 -

Il Pianoforte in Ateneo Il Pianoforte in Ateneo

Milano - 25 settembre 2025 -

Ciclo di seminari a.a. 2024/2025 FORmazione MEtodologica (FORME)

Milano - 09 ottobre 2025 -

Il Pianoforte in Ateneo Il Pianoforte in Ateneo

Milano - 16 ottobre 2025 -

Il Pianoforte in Ateneo Il Pianoforte in Ateneo

Milano - 13 novembre 2025

Succede in ateneo

Milano

Banca, fiducia e società nell’epoca dell’incertezza Ne discuteranno nell'ambito del Soul Festival, giovedì 20 marzo, al Museo Diocesano (ore 17), il rettore Elena Beccalli e Gian Maria Gros-Pietro, Presidente Intesa Sanpaolo Info

Milano

Master Msba, Graduation Day con Milena Gabanelli La nota giornalista keynote speaker dell’evento conclusivo del Master in Sustainable Business Admnistration: «La vostra determinazione e sostenibilità – ha detto agli studenti - saranno la chiave per affrontare sfide del futuro»

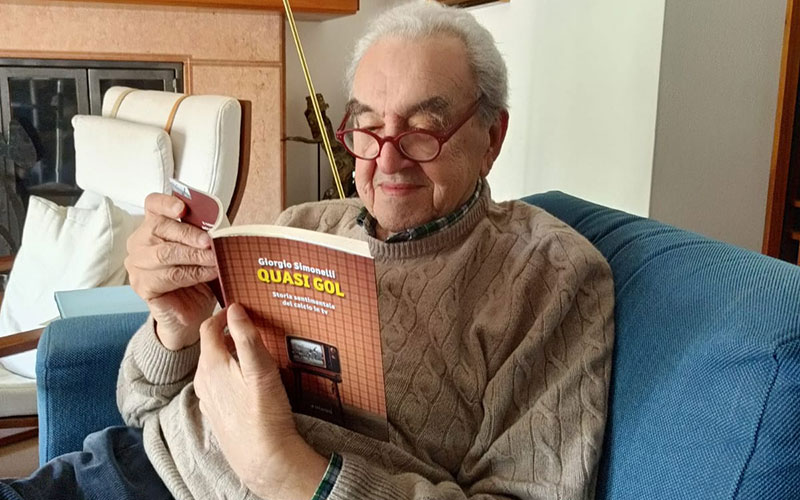

Lutto

Bruno Pizzul, il più bravo di tutti Dopo la scomparsa del grande telecronista, il nostro docente Giorgio Simonelli ha ritratto l’amico e il maestro con cui ha sempre condiviso la passione per il calcioPiacenza

Testimoni in cattedra. Gianni Franco Papa, ad di BPER Banca, dialoga con gli studenti Gianni Franco Papa, amministratore delegato di BPER, ospite in Cattolica a Piacenza per un dialogo con gli studenti di Economia e Giurisprudenza.Milano

Monica Maggioni, dalla Cattolica ai fronti di guerra La giornalista Rai, alumna dell’Ateneo, protagonista del ciclo “Raccontare la guerra” promosso da AseriMilano

L’Italia secondo Auditel In Cattolica la presentazione del volume che celebra i 40 anni della società di analisi dei dati d’ascolto tv. Ospite speciale Gerry ScottiRoma

La scomparsa di Giovanni Scambia Dopo una breve malattia, è morto al Gemelli il professore Ordinario di Ginecologia e Ostetricia della Cattolica, Direttore Scientifico dell’IRCCS Fondazione Policlinico Universitario A. Gemelli, tra i massimi specialisti mondiali in Ginecologia Oncologicalive soon

africa, inaugurazione anno accademico

Dies Academicus 2024 – 2025 | Sede di Piacenza e Cremona Redazione

africa, inaugurazione anno accademico

Dies Academicus 2024 – 2025 a Brescia. Il discorso integrale di Firmin Edouard Matoko Firmin Edouard Matoko

africa, inaugurazione anno accademico

Inaugurazione Anno Accademico 2024/25 a Roma. La prolusione di don Dante Carraro Dante Carraro

inclusione

Ma non si può più dire niente? Il linguaggio inclusivo tra resistenze e cambiamenti Claudia Manzi, Alexandra Young

letteratura, pari opportunità

Donne per la pace impegno e dialogo contro le guerre Raffaella Iafrate, Claudia Mazzucato

demografia, lavoro

Italia 2050 Che paese sarà l’Italia nel 2050? È possibile oggi capire che strada prendere per governare i cambiamenti in atto? Per governare l'incertezza del futuro bisogna evitare di semplificare problemi complessi. Dobbiamo pensare a lungo termine, considerare tutte le variabili in gioco e creare una rete globale di conoscenza. A cura di Marzio Mian e Nicola Scevola 5 episodi

inclusione

Tutti inclusi Un viaggio tra le voci dell’Università per esplorare gli effetti dell’intelligenza artificiale nella nostra vita. Perchè i robot sono già qui con noi. O forse contro di noi. Alleati dell’uomo o nemici dell’umanità? Massima espressione di intelligenza oppure d’incoscienza? 5 episodi

migranti

Sconfinati L’onda dei profughi in fuga dalla guerra in Ucraina sconvolge l’Europa e impone di aggiornare il dibattito sugli esodi e l’accoglienza, fenomeni che da decenni dividono le coscienze e la politica del Vecchio Continente. Le voci-guida sono quelle degli esperti dell'Ateneo, integrate da testimonianze nazionali e internazionali di primo piano. Una serie podcast in cinque puntate dell'Università Cattolica a cura Marzio Mian e Nicola Scevola, pubblicata su Avvenire 5 episodi

migranti, politica estera

2025, andata o ritorno Una serie di Avvenire realizzata in collaborazione con l’Università Cattolica, che trae spunto dai grandi temi emersi alla Settimana sociale dei Cattolici italiani di Trieste. Cinque puntate per cinque dimensioni chiave di un anno, il prossimo, che si preannuncia come un sottile e delicato crinale. 5 episodi

media

Io sono la radio Una serie a cura degli studenti del Master Fare Radio dell'Università Cattolica del Sacro Cuore 5 episodi

letteratura, pedagogia

Ritratti di un tempo Ci sono personaggi che segnano un’epoca. Alcuni di fama indiscussa sono diventati miti o “leggende”, altri meno noti alle grandi platee sono riconosciuti perché hanno contribuito a una scoperta scientifica, hanno vinto un Premio Nobel, o hanno avuto una vita spiritualmente esemplare, o sono diventati un’icona del loro tempo in campo letterario, artistico, musicale. Attraverso queste donne e questi uomini, prende forma di volta in volta un periodo storico, una generazione, una cultura. Affidiamo questi ritratti ai docenti dell’Università Cattolica del Sacro Cuore per ascoltare racconti, aneddoti, interpretazioni e lasciarsi trasportare da provocazioni e suggestioni. 11 episodi

sociologia

Padri e Madri della Sociologia Racconti, aneddoti e storie di chi ha formato le idee sulla società. Li raccontano in questa serie podcast le autrici e gli autori che hanno contribuito alla stesura del manuale di Sociologia generale (Vita e Pensiero, 2022) curato da Rita Bichi 7 episodi